Nyc Department Of Finance Commercial Motor Vehicle Tax

Ways to get help you can get answers to questions about the tax or help with filing and paying. Formerly when the commercial motor vehicle tax was paid the department of finance issued a stamp that was required to be displayed on the vehicle as evidence that the commercial motor vehicle tax.

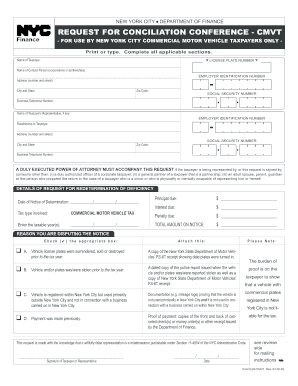

Cmvtfinancenycgov Fill Online Printable Fillable Blank

Cmvtfinancenycgov Fill Online Printable Fillable Blank

nyc department of finance commercial motor vehicle tax is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark nyc department of finance commercial motor vehicle tax using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

This does not include interest on the quarterly returns and the current rate of interest is used to calculate interest for future periods for which the rate has not yet been set.

Nyc department of finance commercial motor vehicle tax. To pay this tax you can appear at the nyc department of finance commercial motor vehicle tax section 66 john street 2nd floor in downtown manhattan with your vehicle registration number or just fax a request for a tax stamp return with a copy. Commercial motor vehicle tax. If you leased the vehicle see register a leased vehicle.

The dmv calculates and collects the sales tax and issues a sales tax receipt. Briannas law requires all motorboat operators to complete a boating safety course. Nyc department of finance dof commercial motor vehicle unit 66 john street 2nd floor new york ny 10038 cmvt at financenycgov for further assistance please call 311 and ask for.

If the minimum amount is not paid on time a penalty may be imposed. Motor vehicle tax these rules apply to owners of commercial motor vehicles and motor vehicles operated for the transportation of passengers. No interest is paid by the department of finance on commercial motor vehicle tax refunds or credits.

Forms and reports the department of finance mails the motor vehicle tax return by june 1 each year to owners of non passenger commercial motor vehicles. To avoid being charged an underpayment penalty for underpayments of estimated tax you should file form nyc 222 nyc 22b or nyc 221. If you need a copy.

All motor vehicles used to transport passengers that are registered within new york city. Nyc department of finance commercial motor vehicle tax section 66 john street 2nd floor new york ny 10038. For the commercial rent tax the calculator computes only the interest accrued from the due date of the annual return.

If the vehicle was a gift or was purchased from a family member use the statement of transaction sales tax form pdf at ny state department of tax and finance dtf 802 to receive a sales tax exemption. The tax return must be filed by june 20th of each year or within 2 days of acquiring the vehicle. New age requirements begin january 1 2020 with full compliance by january 1 2025.

Sign in with an external account facebook google azure ad linkedin microsoft twitter yahoo. If payments are mailed the department of finance dof uses the postmark date as the official receipt date.

Audit Of The Reliability And Accuracy Of Commercial Motor

Audit Of The Reliability And Accuracy Of Commercial Motor

Nyc Dot Trucks And Commercial Vehicles

Nyc Dot Trucks And Commercial Vehicles

Nyc Dot Trucks And Commercial Vehicles

Nyc Dot Trucks And Commercial Vehicles

New York Hut Permit Truckinginside Com

New York Hut Permit Truckinginside Com

Cmvt Nyc Fill Online Printable Fillable Blank Pdffiller

Cmvt Nyc Fill Online Printable Fillable Blank Pdffiller

Nyc Dot Trucks And Commercial Vehicles

Nyc Dot Trucks And Commercial Vehicles

Congestion Pricing In New York City Wikipedia

Congestion Pricing In New York City Wikipedia

New York City Transit Authority Wikipedia

New York City Transit Authority Wikipedia

Evidence Recommendations Nyc Gov Finance

Evidence Recommendations Nyc Gov Finance

Ny State And New York City S Emerging Sustainable Finance

Ny State And New York City S Emerging Sustainable Finance