Advantages Of Equity Financing Over Debt Financing

The more debt financing you use the higher the risk of bankruptcy. Debt financing refers to a loan you take out usually from a financial institution.

Debt Financing Vs Equity Financing Advantages Disadvantages

advantages of equity financing over debt financing is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark advantages of equity financing over debt financing using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Any time you use debt financing you are running the risk of bankruptcy.

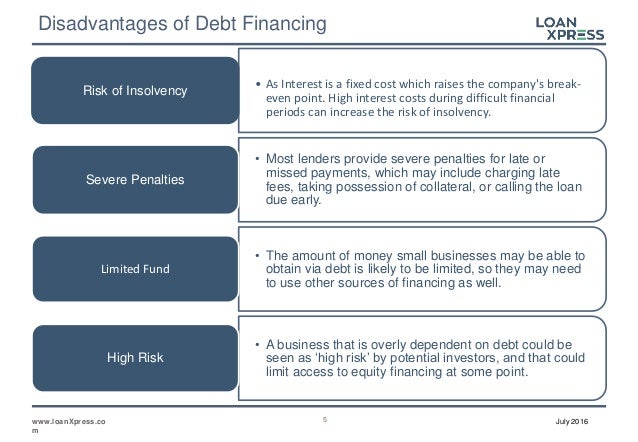

Advantages of equity financing over debt financing. The following table discusses the advantages and disadvantages of debt financing as compared to equity financing. Most companies use a combination of debt and equity financing but there are some distinct advantages of equity financing over debt financing. Youll owe that money back at some point.

The primary difference between debt vs equity financing is that debt financing is the process in which the capital is raised by the company by selling the debt instruments to the investors whereas equity financing is a process in which the capital is raised by the company by selling the shares of the company to the public. Calculate the debt to equity ratio to determine how much debt your firm is in compared to its equity. Equity financing is investment money that comes from people who want a stake in your business.

Advantages of debt compared to equity because the lender does not have a claim to equity in the business debt does not dilute the owners ownership interest in the company. A company that has a significantly greater amount of debt than equity financing is considered risky. Principal among them is that equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business.

There are benefits and pitfalls to each of these two options to consider. A company with a lower credit rating that issues bonds typically will have to pay a higher interest rate to attract investors. Another disadvantage is that debt financing affects the credit rating of a business.

Debt Financing Vs Equity Financing What S The Difference

Dr Ebi Ofrey Business Advisor Series Financing Options

What Is Debt Financing Metrics To Analyze Advantages

Funding Options For A Corporation In India India Briefing News

Solved Advantages Of Debt Financing Over Equity Financing

3 1 Sources Of Finance Key Outcomes Ppt Download

Dr Ebi Ofrey Business Advisor Series Financing Options

Debt Vs Equity Financing Advantages Disadvantages Example

Benefits And Disadvantages Of Equity Shares Investment

Debt Vs Equity Financing Which Is Best For Your Business