How To Calculate Amount Financed In Excel

Amount financed is the actual amount of credit made available to a borrower in a loan. Most lenders for these types of loans require a down payment of some sort usually expressed as a percentage.

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

how to calculate amount financed in excel is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how to calculate amount financed in excel using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

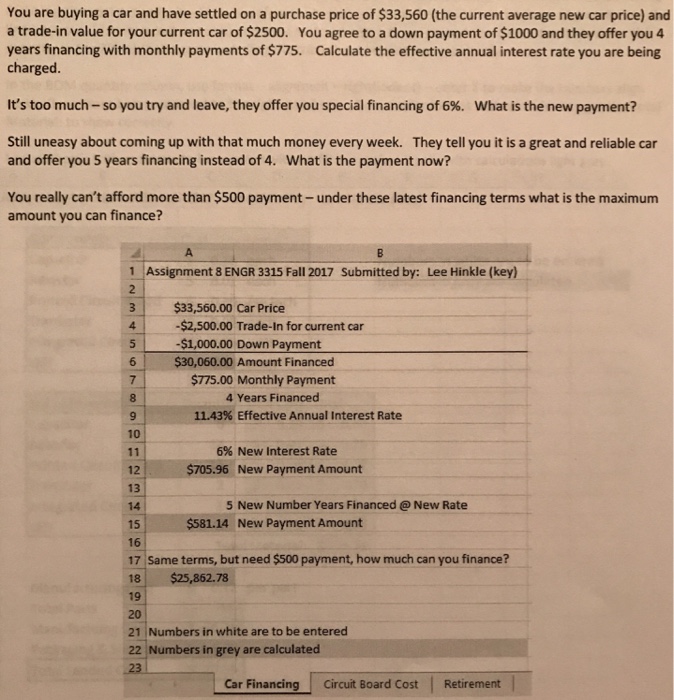

The amount the interest rate the number of periodic payments the loan term and a payment amount per period.

How to calculate amount financed in excel. How do i caculate the amount financed by subtracting the down payment form the selling price. I have the sale price a loan term b interist rate c and down payment d. A loan calculator created in microsoft excel is capable of determining a number of different factors related to a standard installment loan.

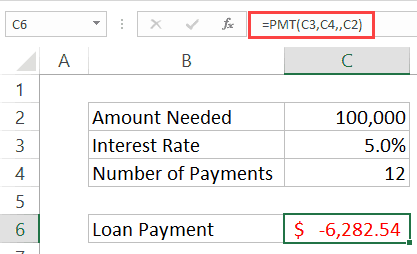

Prior to purchase a loan calculator can project the. To calculate the periodic interest rate for a loan given the loan amount the number of payment periods and the payment amount you can use the rate function. Loans have four primary components.

How do i calculate the amount financed in excel. The full price of a major purchase such as a house boat or car is rarely financed. Excel formulas can help you calculate the future value of your debts and investments making it easier to figure out how long it will take for you to reach your goals.

What would the formula look like. How to calculate apr for a payday loan. One use of the pv function is to calculate the the original loan amount when given the other 3 components.

Managing personal finances can be a challenge especially when trying to plan your payments and savings. Heres how to calculate the apr on a payday loan or any other loan with a single repayment. Not sure what i am doing wrong.

Take the cost of the loan in interest and finance charges and divide it by the amount borrowed or current balance. In the example shown the formula in c10 is. Do i use the vlookup pmt if or just the sum.

How to calculate amount financed in excel. I have the total selling price and the down payment provided and need to calculate the amount financed. Rate c7 c6 c5 12 loans have.

Inside the table well calculate what the monthly payments will be if we substitute these values for whats in b3 and b4 giving you an easy way to see how your payments would differ if your loan amount or interest rate vary. How to calculate an amount to be financed. It is the total amount of credit a borrower is approved for from a lender.

I tried just subtracting the total from the down payment 15340 1000 but it comes out to a strange percentage 14340000. The amount financed is an important factor for calculating the installment payments that a borrower will have to pay over the life of the loan. I am confused on how to construct the formula.

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

4 Ways To Calculate Amount Financed In Excel Wikihow

Excel Formula Calculate Original Loan Amount Exceljet

Excel Formula Calculate Original Loan Amount Exceljet

How To Calculate A Car Loan In Excel 10 Steps With Pictures

How To Calculate A Car Loan In Excel 10 Steps With Pictures

How To Calculate A Monthly Loan Payment In Excel Mortgage

How To Calculate A Monthly Loan Payment In Excel Mortgage

Excel Formula Calculate Original Loan Amount Exceljet

Excel Formula Calculate Original Loan Amount Exceljet

How To Calculate A Car Loan In Excel 10 Steps With Pictures

How To Calculate A Car Loan In Excel 10 Steps With Pictures

Excel Pmt Function To Calculate Loan Payment Amount

Excel Pmt Function To Calculate Loan Payment Amount