How Much Does A Car Have To Be To Finance

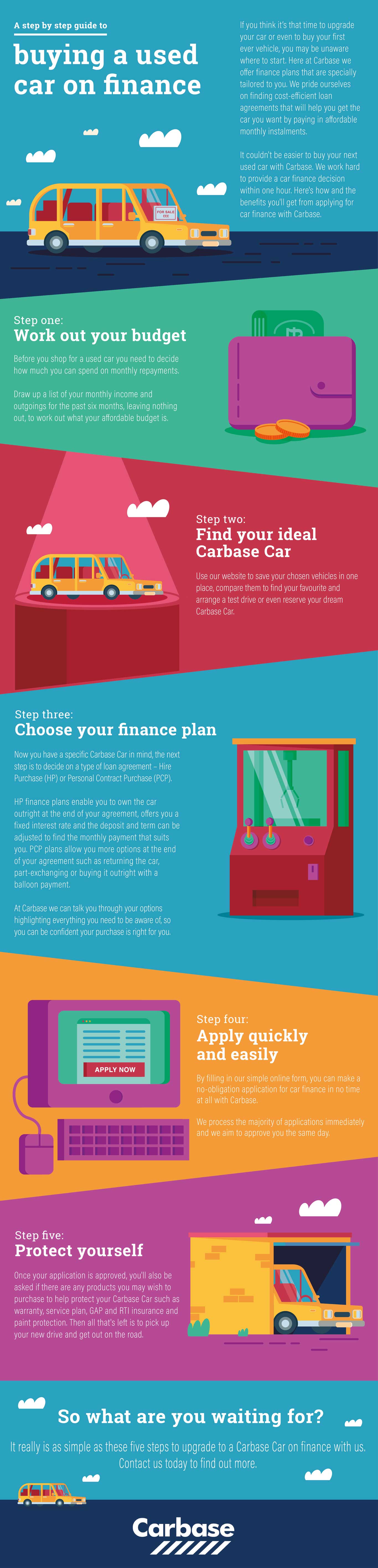

Financing a car may seem a little overwhelming particularly for a first time car buyer. When shopping for a new or used car it is always helpful to have an idea of how much you can spend.

What Your Car Really Costs You Marketwatch

how much does a car have to be to finance is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how much does a car have to be to finance using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Then well show your likely repayments based on a low moderate and high apr.

How much does a car have to be to finance. Know the true cost of financing when buying a car. Car loan repayments reduce the amount of income left to service a new home loan explains thomas lynch finance specialist with step one finance. The first stage is to decide on the type of deal you want.

This car finance calculator shows you what your monthly repayments are likely to be based on your loan amount. The true cost of financing a car depends on interest rates monthly payments credit risk and more. Finance manager salary sala.

Lenders will want to be listed as a loss payee and possibly as additional insured on the car they have financed the purchase of. Looking for a great car finance deal. But even though a car is one of the biggest purchases most people will ever make apart from buying a house understanding car financing doesnt have to be a big deal.

A personal loan is the most. Shop smart for car financing. Then its a case of choosing the provider whose product best suits your needs.

You will definitely have to fill out a bit more paperwork if you finance your car through a bank or other traditional financial institution than if you pay for the vehicle in cash. To find you a competitive quote at a great rate for new and used car buying. This is known as your debt to income ratio and owing money on a car loan can have a significant impact on your ability to qualify for a mortgage.

Just select how much you want to borrow and how long you want the agreement to last. This should give you a. If youre using credit youll get the best deals if you have a good credit score.

Understanding what you can manage as a monthly payment not only helps you narrow down your used or new car search it can help you identify dealerships and auto finance specialists that can work with your established budget. If youre not paying with cash youll be using car finance or credit to buy your car. It depends on the size of the dealership the skill of the manager the type of dealership ownermanagement staff but as a general rule finance managers earn 50 200k per year with most earning about 75k a year.

Credit scores and car finance. Car finance might seem daunting but in reality its just a simple two stage process. Loan lease hire purchase or dealer finance.

Remember just because your credit score is good and youre allowed to borrow a larger amount it doesnt mean youll be able to.

What Credit Score Is Needed To Buy A Car Bankrate Com

Top 5 Worst Car Buying Mistakes Credit Com

Prepared To Get Into Personal Finance Check This Out

Looking At Cars Read This Article First

The No 1 Mistake Car Buyers Make According To Millionaire

Van Finance Bad Credit By Grsrent2buy Issuu

How Much Should A Car Down Payment Be Edmunds

Ten Golden Rules To Follow When Taking A Loan The Economic

Vehicle Shopping Tips Made Easy In This Article

Pcp Personal Contract Purchase Finance All You Need To

Bad Credit Car Loans Available With Instant Approval